I will preface this post by saying a family’s finances and budget are probably one of the most vulnerable areas to reveal to others. However, this system has worked so well for us that I truly believe in sharing it with you. So….read on and take a look into my life.

Several years ago, my husband and I took Dave Ramsey’s “Financial Peace University” class at our church. We walked away with a lot of great information, but we weren’t totally feeling all of it. If you’re unfamiliar with it, the basic concept is setting a budget through an envelope system. You pay your essential bills (mortgage, electricity, car payment, etc.). Then, budget by placing X amount of money in envelopes for groceries, toiletries, eating out, and the other things you deem necessary. Next, you save up $1,000 for your emergency fund (the basic principle being that when you’re prepared, emergencies don’t happen). Lastly, use the money remaining to pay your debt (i.e., credit cards) using the snowball effect. The goal is to use the money in those envelopes for their intended purpose and nothing more. That way, all of your “extra” money can go towards the mentioned debts. If you don’t have credit card debt, use your “extra” income to pay off your car(s) or mortgage quicker than your loan period, and then build your savings.

Hopefully, I didn’t completely lose you in the above paragraph. All of this sounds great and encouraging; however, you have to be ready to c.o.m.m.i.t. Hardcore. We just weren’t in that place at that time, so we came up with our own little budget spinoff (no offense, Mr. Ramsey). It’s worked so well for us, and we’re coming up on our fifth year of the Heep System.

OUR SYSTEM

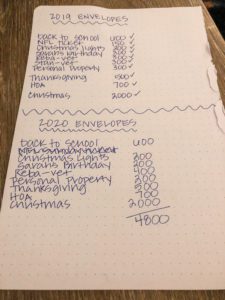

At the beginning of the year, we write out a list of all of the significant expenses we know that we will have and how much we anticipate them costing. Back-to-school expenses, veterinary appointments, HOA dues, etc. Each year we revamp the list. This year, we don’t need to budget for an additional vet appointment (RIP Sir Stanley), and we eliminated saving for the NFL Sunday ticket and instead opted to pay for it in installments with our service provider. We were also able to lower our personal property estimate based on what we paid this year.

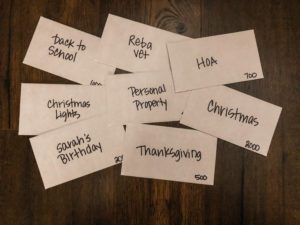

Once we’ve agreed on the list, I write each expense on an envelope and the amount we need. Then the saving begins. We typically start with the smallest envelopes, and each pay period, we add to one of them. (Don’t get any ideas, it’s all in a safe and we are pro-gun. Just sayin’. ?) Once we have filled an envelope, it’s off to our savings account.

When the expense arises, the money is there. It doesn’t go on a credit card, we don’t go without enough groceries, and we pay all of our bills. The budget is 100% customizable. Maybe your most substantial goal is only $100, or perhaps your smallest goal is $500. Make it work for your income, your finances, and your life. It has taken a couple of years to get it to work right for us. When each expense approaches, it is such a relief to be able to tear open an envelope or dip into savings knowing that it’s budgeted and paid for.

When the expense arises, the money is there. It doesn’t go on a credit card, we don’t go without enough groceries, and we pay all of our bills. The budget is 100% customizable. Maybe your most substantial goal is only $100, or perhaps your smallest goal is $500. Make it work for your income, your finances, and your life. It has taken a couple of years to get it to work right for us. When each expense approaches, it is such a relief to be able to tear open an envelope or dip into savings knowing that it’s budgeted and paid for.

Make your money work for you! Happy Saving.

There are so many good tips here. It would be such a relief to have big expenses covered from the start, especially personal property taxes and things like that. I am definitely going to rethink our budgeting!!

Comments are closed.